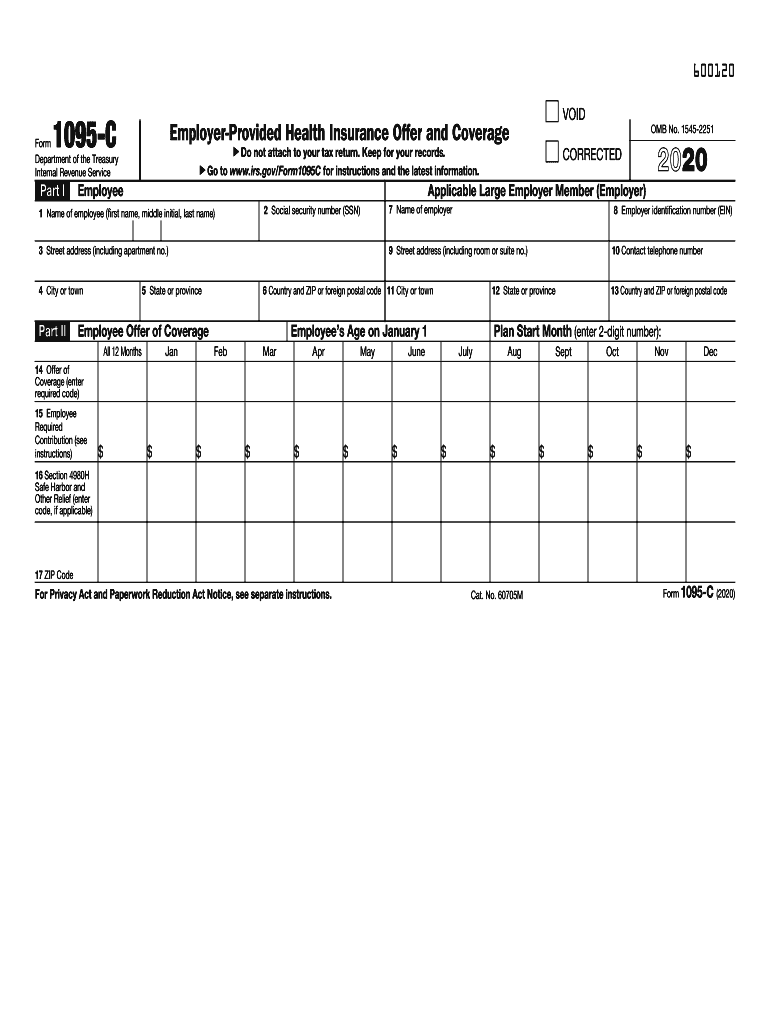

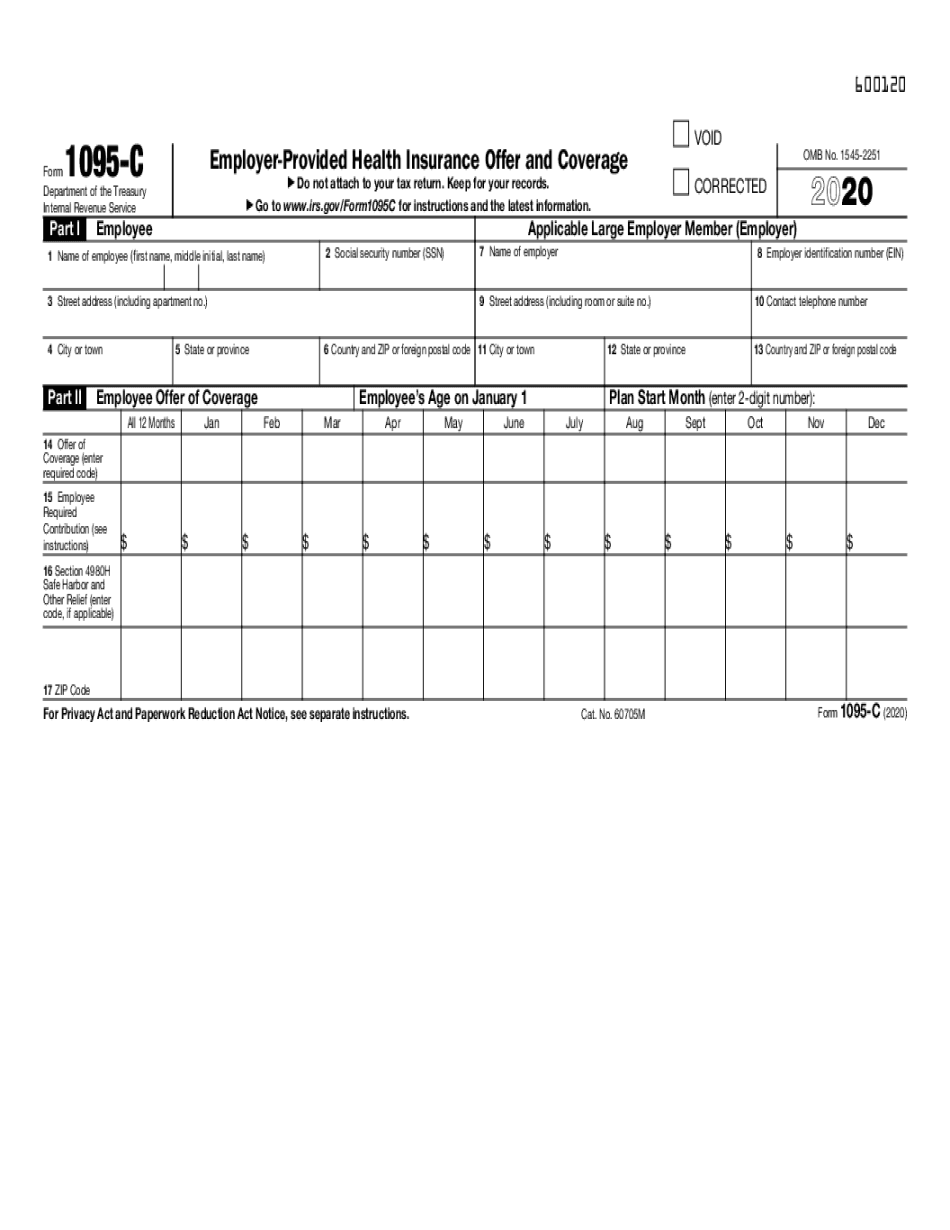

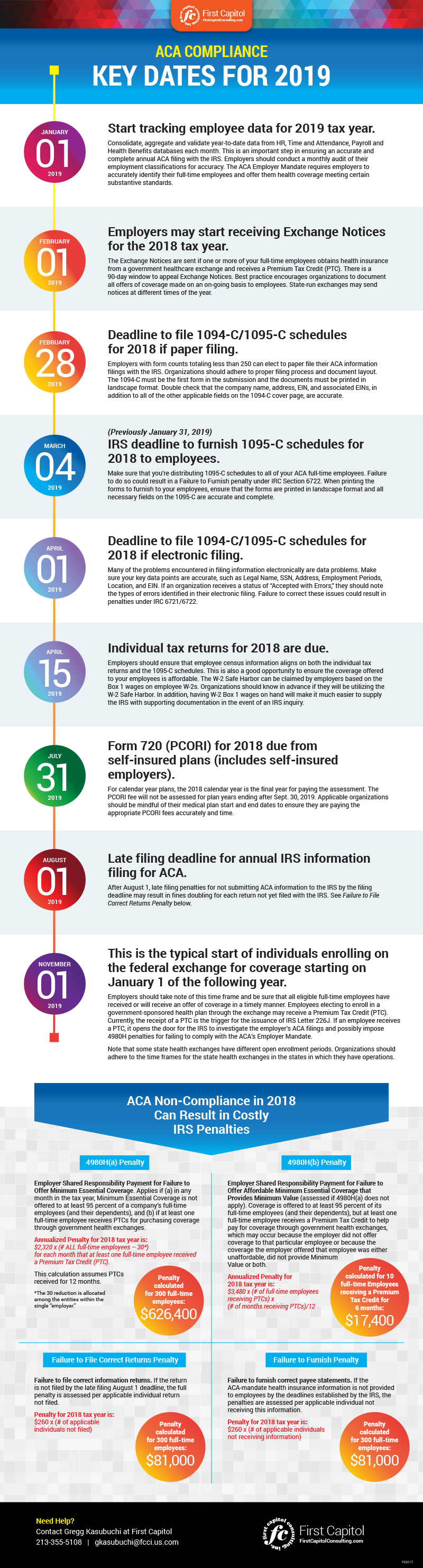

A corrected Form 1095C must be sent along with a 1094C transmittal form Be sure to only check the "corrected" box on the Form 1095C, not 1094C A copy of the corrected form must also be furnished to the employee Again, refer to the Each FullTime employee must be provided an IRS Form 1095C by IRS Form 1094C, along with all FullTime employees' Form 1095Cs, must be transmitted to the IRS by March 31 every year (April 1 in 19), if an employer files these Forms electronically Employers who issue less than 250 1095C information returns may file paper copies of the Forms, IRS Form 1094C remains unchanged from prior years IRS Form 1095C tax year form changes include a new line 17, new offer codes and box for employee's age Rise of the State Individual Mandates DC and NJ enacted their own individual mandates requiring taxpayers to prove health coverage beginning in tax year 19

2

Form 1094-c deadline 2019

Form 1094-c deadline 2019-One of these Forms 1094C should be identified as the Authoritative Transmittal on line 19, and should include aggregate employerlevel data for all 1,0 fulltime employees of Employer B as well as the total number of employees of Employer B, as applicable, as required in Parts II, III, and IV of Form 1094C IRS Releases Draft 19 Instructions for Forms 1094/1095 After a lengthy and unexplained delay, the Internal Revenue Service released drafts of the 19 Forms 1094C, 1095C and their corresponding instructions on The forms and reporting obligations are basically unchanged from 18

2

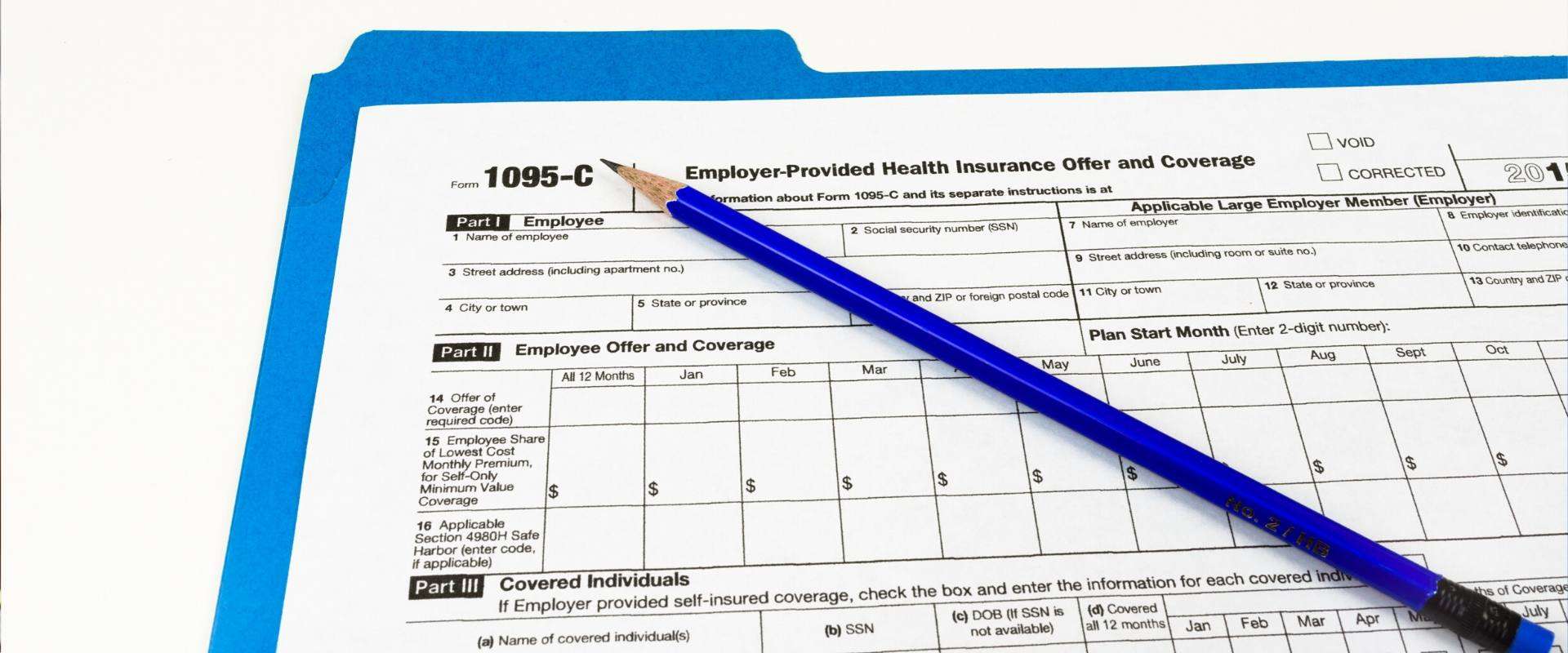

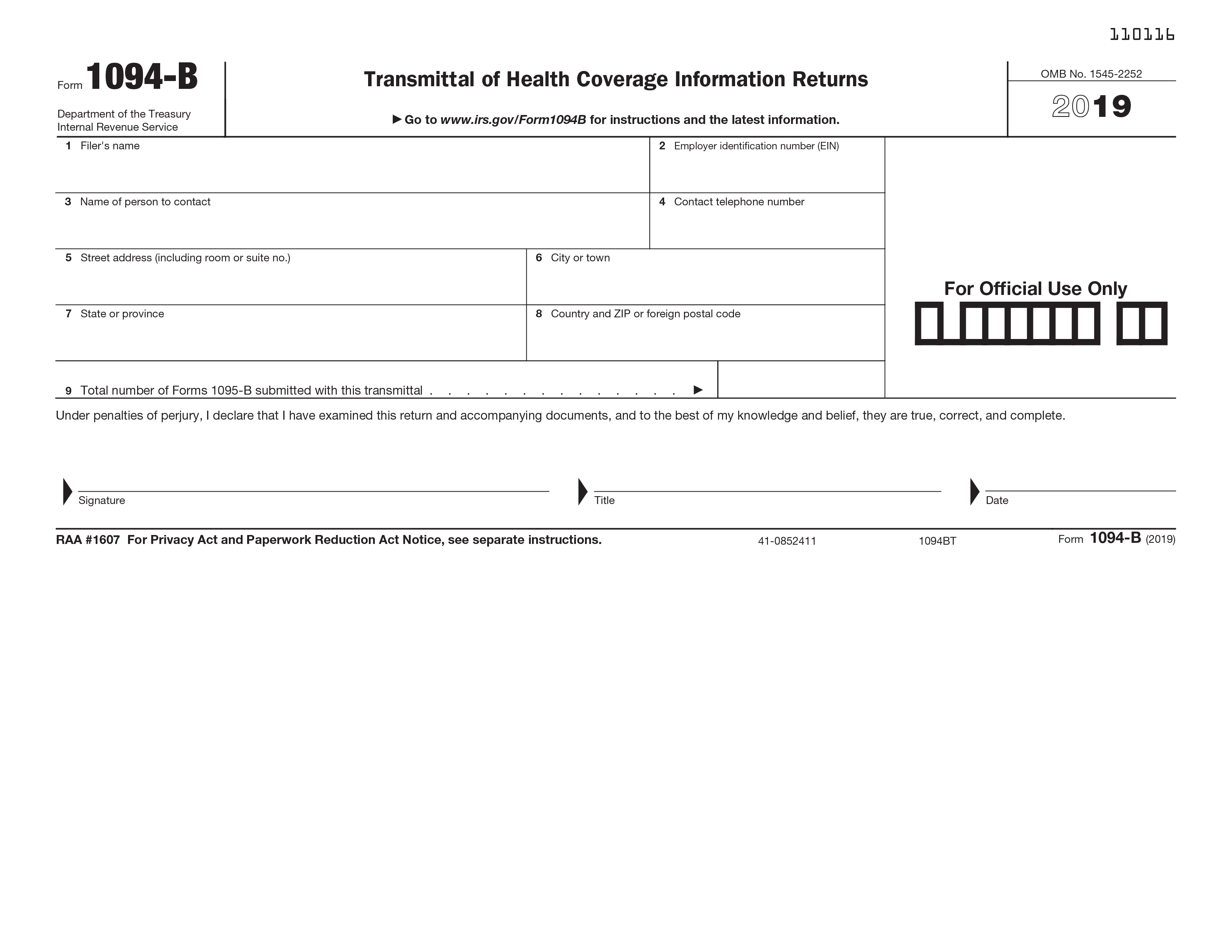

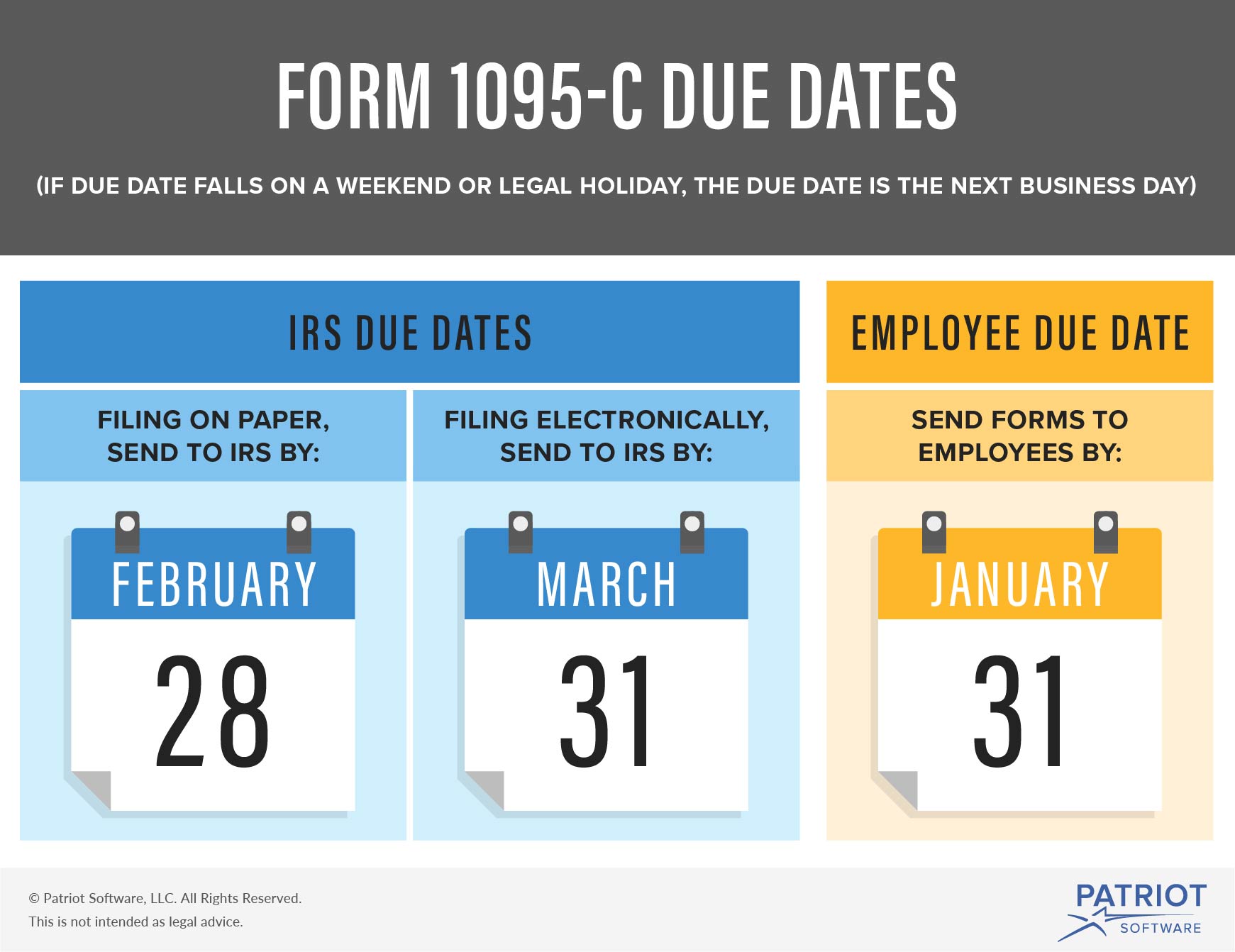

Form 1094C is only sent to the IRS, not to employees Form 1094C 19 Tax Year Deadlines Due to recipient January 31st, Paper file 1094C with the IRS March 2nd, Efile 1094C with the IRS March 31st, Note IRS has now extended the recipient copy deadline to from the original due date of January 31 Fill Online, Printable, Fillable, Blank F1094c 19 Form 1094C Form Use Fill to complete blank online IRS pdf forms for free Once completed you can sign your fillable form or send for signing All forms are printable and downloadable The F1094c 19 Form 1094C form is 3 pages long and containsForm 1094C is essentially a cover sheet for 1095C and is only sent to the IRS The Role of the 1095C The Affordable Care Act requires employers with at least 50 fulltime employees to provide health insurance to their employees

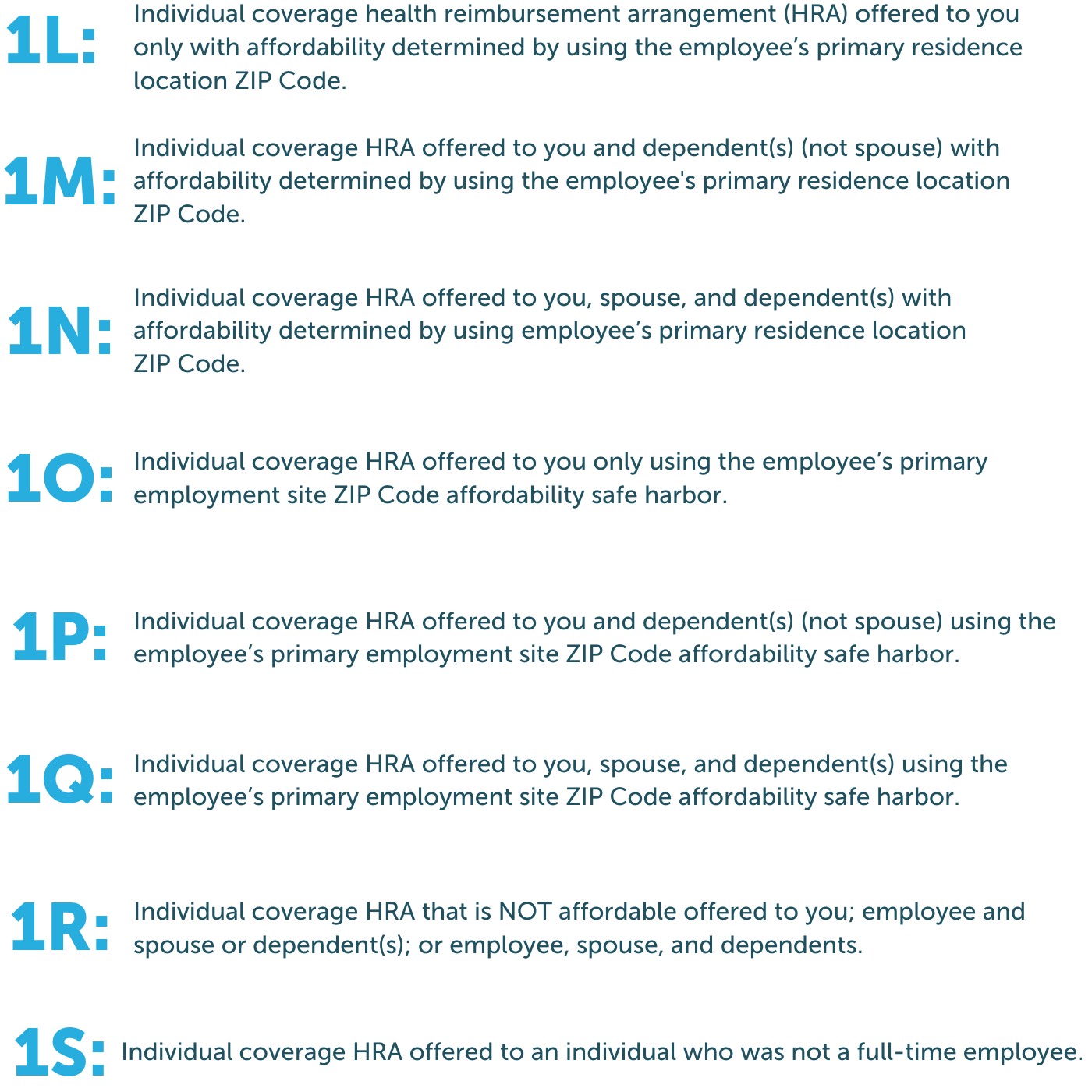

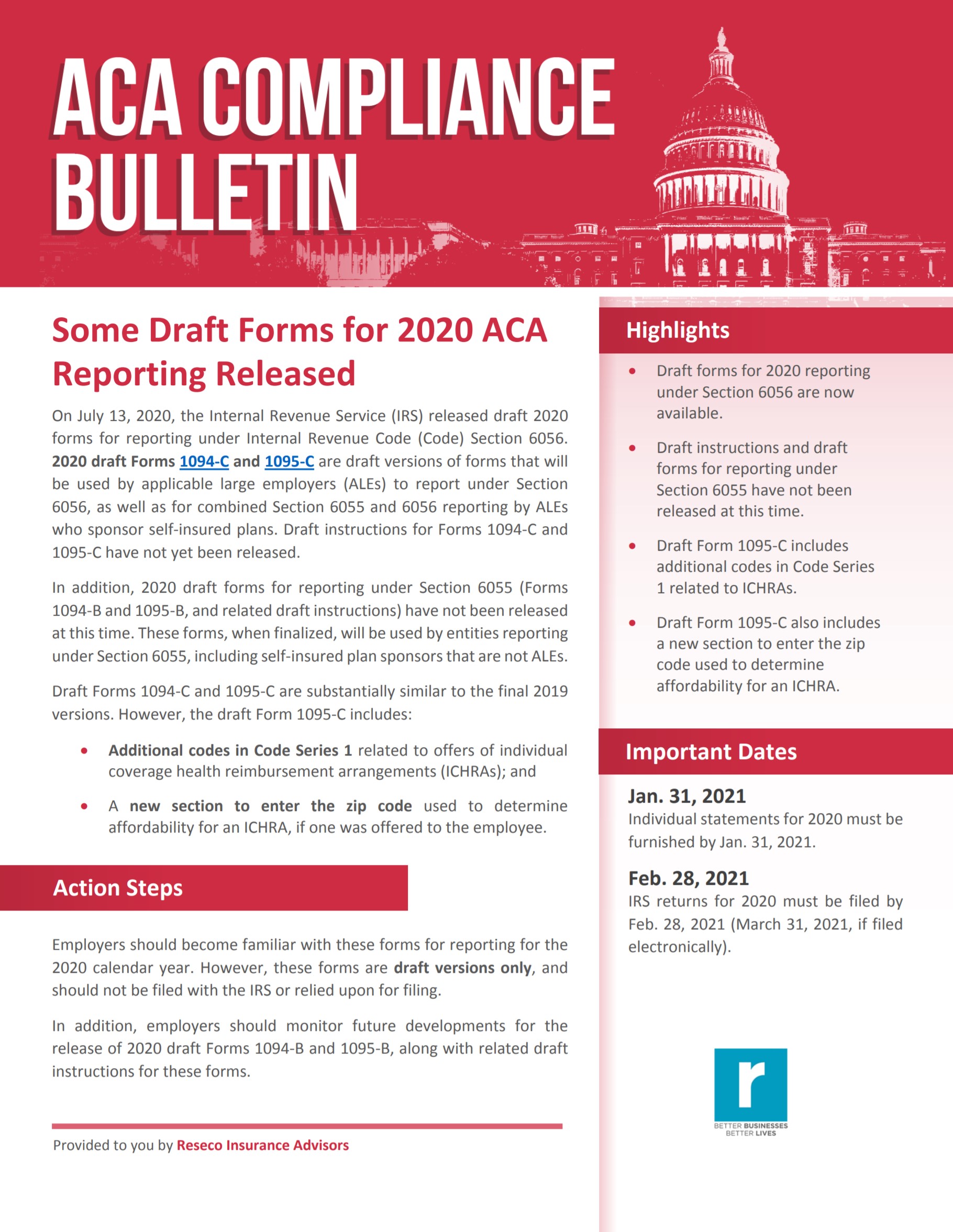

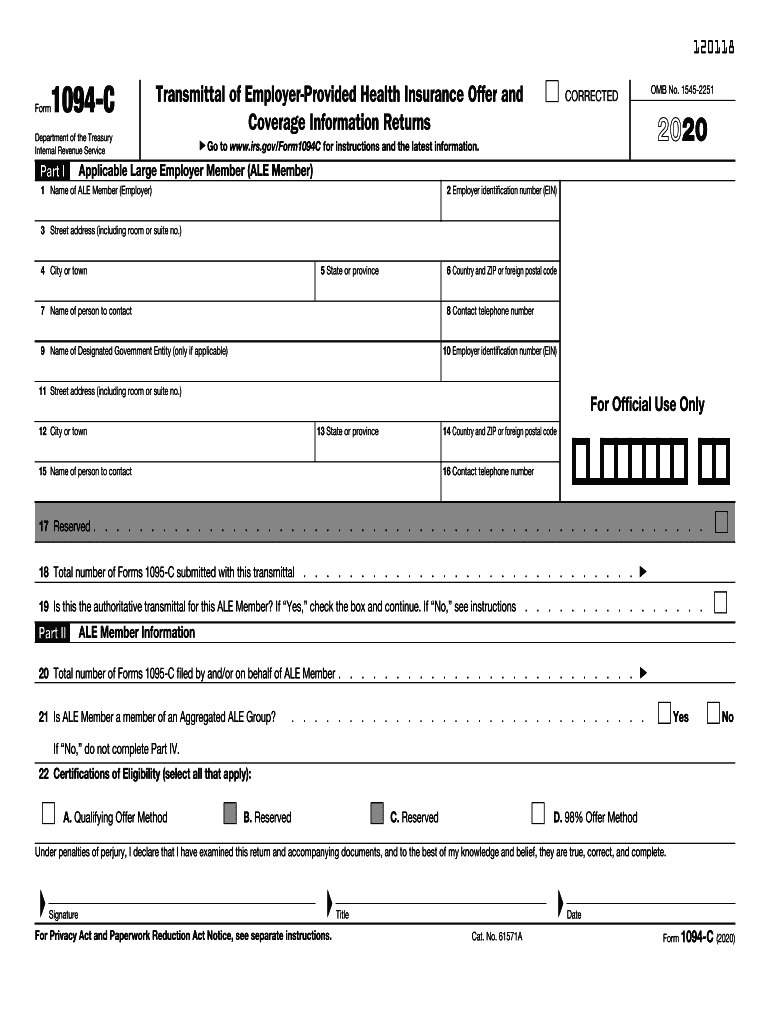

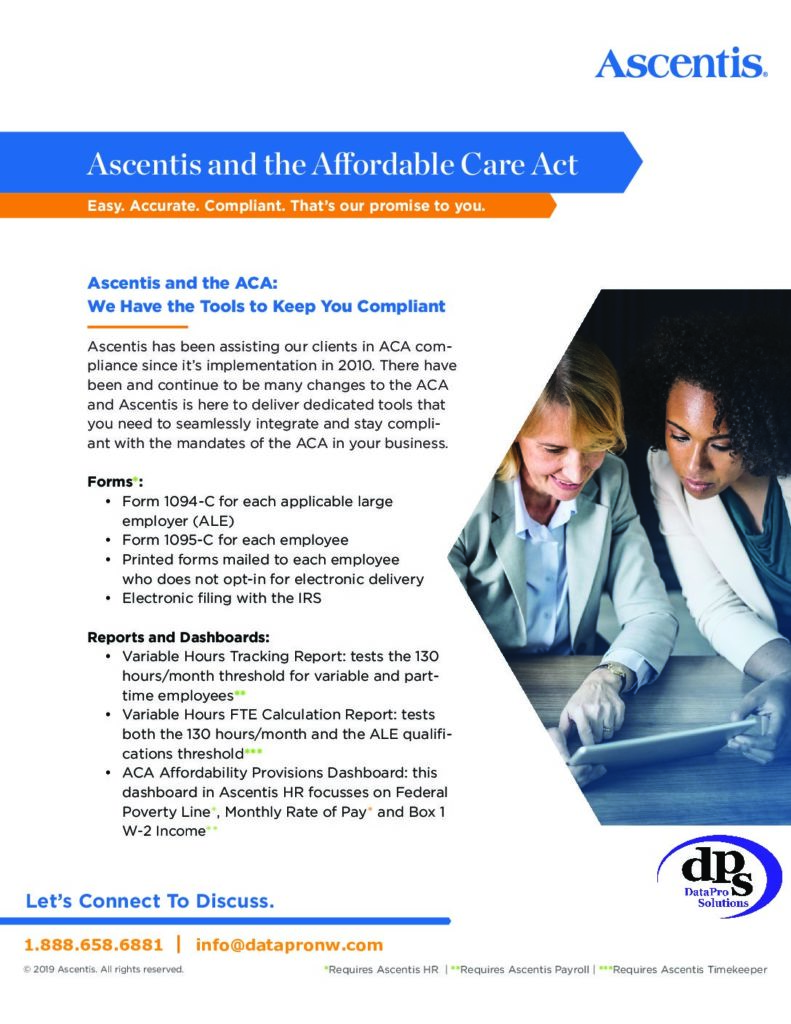

The Affordable Care Act (ACA) imposes demanding reporting responsibilities on employers each calendar year since 15 The reporting stipulation states that an information return will be prepared for each applicable employee, and these returns must be filed with the IRS using a single transmittal form (Form 1094B & 1095B or Form 1094C & 1095C) Last week, the IRS issued it updated Form 1094C and 1095C instructions for 19 Employers that employ New Jersey residents, however, may have more reading to do New Jersey responded to the federal repeal of the Affordable Care Act's (ACA) individual mandate, by enacting a mandate of its ownIn midNovember, the IRS has released draft instructions for the 19 tax year 1094/1095B and 1094/1095C forms "While these forms are not the final versions to be filed and furnished for the 19 tax year, they do serve as an accurate depiction of what employers should expect when preparing for 19 ACA employer mandate reporting

Understand and complete Forms 1095 C and 1094C (large SDs and SUs) The material goes through linebyline instructions for the forms, provides a few examples (more are included in a dedicated handout) If you have worked on completing these forms last year, this will be a refresher As of the date this material was assembledForm 1094C, Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Return Filing is optional for CY 14, but required for Coverage Years starting in 15 All Applicable Large Employer (ALE) Members are required to file Forms 1094C and 1095C for Coverage Years starting in 16 The 19 reporting is due to be issued to employees by (for Form 1095C) The IRS requires these forms to be submitted to it on or before , if electronically filed (required for 250 or more forms) or Feb 28, , if paper forms are filed

2

W 2 Laser Federal Irs Copy A

Those numbers are reflected in the 19 instructions The rest of the instructions to the Forms 1094C and 1095C are unchanged Therefore, employers are still responsible for furnishing the Form 1095C to the requisite fulltime employees by the deadline The deadline to file the Forms 1094C and 1095C with the IRS is if the Draft C Form Instructions The IRS has released draft Forms 1094/1095B (B Forms) and Forms 1094/1095C (C Forms), and related instructions, for the 19 tax year As a reminder, the B Forms are filed by minimum essential coverage providers (mostly insurers and governmentsponsored programs, but also some selfinsuring employers and others) to report coverage The due date for furnishing 19 Form 1095C is extended from Jan 31, , to Goodfaith transition relief from penalties under sections 6721 and 6722 for incorrect or incomplete information reporting on the returns is extended to the 19 tax filing year

2

Avoid Common Errors This Aca Reporting Season Health E Fx

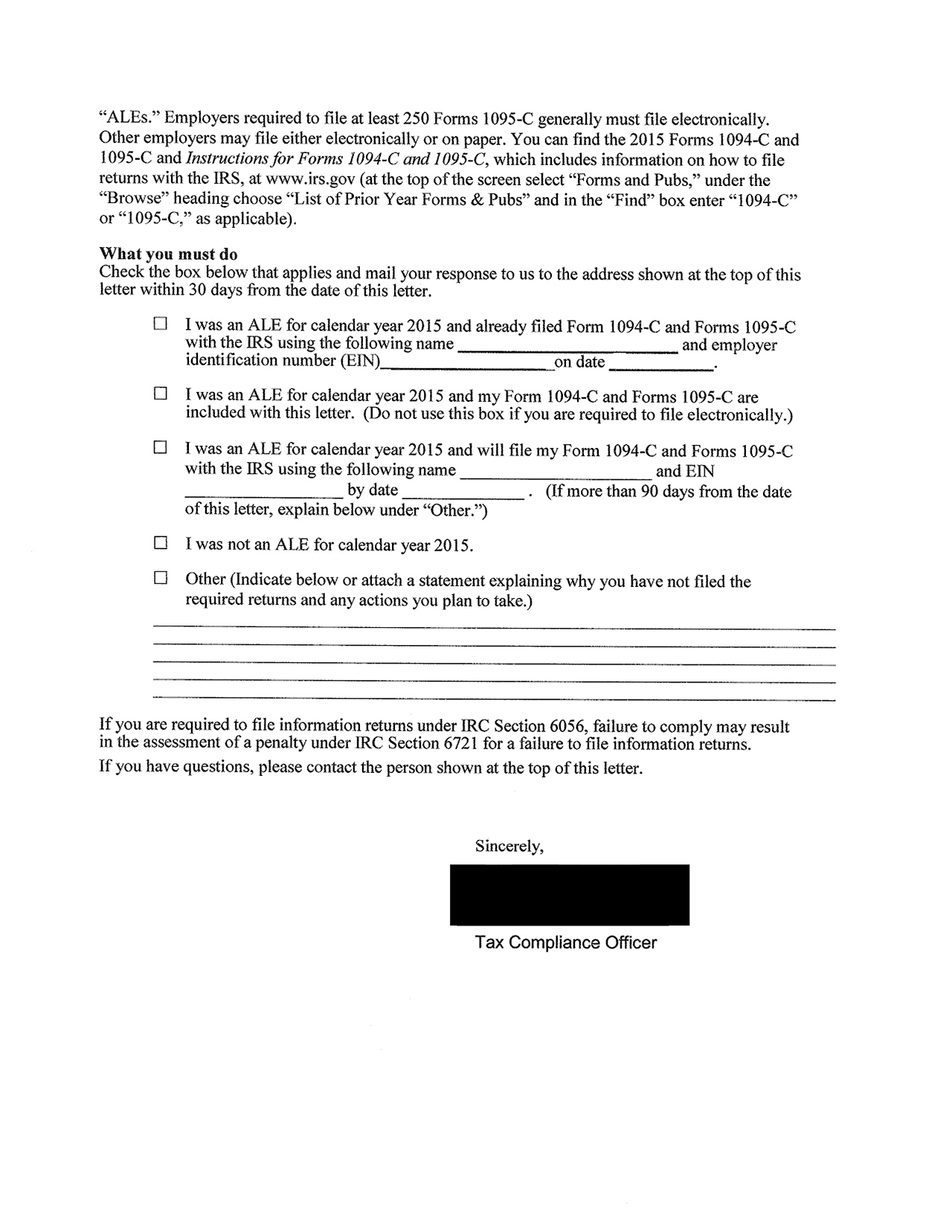

Forms 1094C and 1095C report health care coverage information to the IRS Employers must distribute copies of Form 1095C to fulltime employees If you have less than 50 fulltime employees (including f/t equivalents) you do not have to file these IRS forms I was an ALE for calendar year 19 and already filed Form 1094C and Forms 1095C with the IRS using the following name —— and employer identification number (EIN) —— on date —— I was an ALE for calendar year 19 and have included my Form 1094C and Forms 1095C with this letterInst 1094C and 1095C Instructions for Forms 1094C and 1095C Form 1095A Health Insurance Marketplace Statement Inst 1095A Instructions for Form 1095A, Health Insurance Marketplace Statement Form 1095B

What You Need To Know About Aca Annual Reporting Aps Payroll

Filing Form 1094 C Youtube

Information about Form 1094C, Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns, including recent updates, related forms, and instructions on how to file Form 1094C is the transmittal form that must be filed with the Form 1095C No extension of deadline to file Forms 1094B, 1095B, 1094C, 1095C with the IRS The deadline for filing these 19 forms with the IRS remains (, if filing electronically) However, filers may receive an automatic 30day extension to file with the IRS by submitting Form 09 on or before the due date The 1094C form is not considered a correction by the IRS if it is being submitted as the cover page for one or more corrected 1095C forms The accompanying 1094C form is simply a new form and the data on it should reflect what is being submitted with it (eg, if 1 form needs correcting, Line 18 on the 1094 form will state "1" even

Some Draft Forms For Aca Reporting Released Resecō

2

John Barlament walks through how to fill out IRS forms 1094C and 1095C This presentation was given to selffunded employers at an Alliance Learning Circle The IRS has released draft versions of Forms 1094C and 1095C, as well as the reporting instructions for the 19 tax year, to be filed and furnished in You can find the draft 19 filing instructions by clicking here The draft 19 versions of Form 1094C and 1095C are also available for download at the following links Check out the recently released Form 1095C for the 19 tax year here In addition to filing a 1095C, employers are also required to file a 1094C, which is basically just the cover sheet for all of an organization's 1095C forms (you must file one 1094C per tax ID)

Updated Guidance Released On Employer Reporting For The California Individual Mandate Sequoia

2

C Form Instructions The IRS has released final Forms 1094/1095B (B Forms) and Forms 1094/1095C (C Forms), and related instructions, for the 19 tax year No material changes have been made to the forms, either from prior years or from the drafts released in November (see our Checkpoint article ) (The "Instructions for Recipient" included with FormEmployers are responsible for furnishing their employees with a Form 1095C by Thursday, Employers are still responsible for filing copies of Form 1095C with the IRS by Thursday, , if filing by paper or Monday, , if filing electronically (same as Form 1094C) IRS Forms 1094C and 1095C are filed by employers that are required to offer health insurance coverage to their employees under the Affordable Care Act, also known as Obamacare

2

Form Irs 1094 C Fill Online Printable Fillable Blank Pdffiller

Form 1094C Department of the Treasury Internal Revenue Service Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns Go to wwwirsgov/Form1094C for instructions and the latest information OMB No 19 Part I Applicable Large Employer Member (ALE Member) 1 Name of ALE Member (Employer) 21094C and 1095C to report the information required under sections 6055 and 6056 about offers of health coverage and enrollment in health coverage for their employees Form 1094C must be used to report to the IRS summary information for each ALE Member (defined below) and to transmit Forms 1095C to the IRSThe IRS released nal 19 Form 1094C, Form 1095C and applicable instructions Applicable large employers ( ALEs ) must furnish the Form 1095C to fulltime employees and le Forms 1094C and all 1095Cs with the IRS What s New While the Forms remain substantially the same to last year s versions, the instructions highlight recent changes as

2

7 Must Know 21 Hr Compliance Dates Workest

The IRS imposes penalties for late filing of Forms 1094C and 1095C or for late furnishing of Forms 1095C under Internal Revenue Code (IRC) Sections 6721 and 6722 These penalties can be huge depending on the number of late Forms 1095C, at a rate of $270 per form for failure to file and an additional $270 per form for failure to furnish forForm 1094C gets auto generated based on the 1095C forms input inside the system This saves users time and simplifies the filing process As an employer you can think of the 1095C as the W2 form of ACA healthcare reporting and 1094C as the W3 transmittal of ACA reporting And the due dates are also similar This is a reminder if you are an ALE (Applicable Large Employer) you have until to generate and distribute 1095C forms to your employees and to file a 1094C form with the IRS Read more about Forms 1094C and 1095C here Forms 1094C and 1095C filing date extended to

Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

2

The 19 Form 1095C is due to employees on Form 1094C is similar to Form 1094B This transmittal cover sheet for the Form 1095C is completed by the ALE and contains demographic information to accompany the batch Form 1095C filing Failure to file these forms can cause significant penalties for insurers and employers NonCompliance for 19 Tax Year Applicable Large Employers (ALEs) should take steps to avoid the following common errors in Affordable Care Act (ACA) compliance reporting Although filing the ACA compliance Forms1095C, 1094C, 1095B and 1094B with the IRS can be complicated and timeconsuming, accounting for the following filing mistakesForm 1094C Department of the Treasury Internal Revenue Service Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns Go to wwwirsgov/Form1094C for instructions and the latest information OMB No Part I Applicable Large Employer Member (ALE Member) 1 Name of ALE Member (Employer) 2

Irs Govform1095a Employer Provided Health Insurance Offer In Pdf

Form 1099 Nec Requirements Deadlines And Penalties Efile360

Draft Form 1094C Draft Form 1095C Instructions for Form 1094C and 1095C From the 19 Instructions for Forms 1094C and 1095C Purpose of Form Employers with 50 or more fulltime employees (including fulltime equivalent employees) in the previous year use Forms 1094C and 1095C to report the information required under sections 6055The 1094C and 1095C filings used by Applicable Large Employers along with employee tax returns will be used by the IRS to determine if the employer owes a shared responsibility payment and whether employees are/were eligible for a premium subsidy Any penalties will be calculated and communicated by the IRS in Letter 226J Employers owe the IRS a Form 1094B is essentially a cover sheet used by insurance providers when they send the Internal Revenue Service (IRS) information about who has health coverage that meets the standards of the Affordable Care Act The 1094B is a brief form that takes up less than a page

2

2

Form 1095C EmployerProvided Health Insurance Offer and Coverage 21 Form 1095B Health Coverage 21 Inst 1094B and 1095B Instructions for Forms 1094B and 1095B Inst 1094C and 1095C Instructions for Forms 1094C and 1095CFrom $495 White paper print tax forms 1095 and 1094 on regular printing paper with inkjet or laser printer Form 1095 C EmployerProvided Health Insurance Offer and Coverage Insurance Form 1094 C Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns 1095B Health Coverage The IRS issued final versions for four ACA forms, including Forms 1094B, 1095B, 1094C, and 1095C The forms can be accessed using the following links Form 1094B Form 1095B Form 1094C Form 1095C The IRS also released full instructions for Forms 1094C and 1095C for employers and HR teams, as well as instructions for Forms 1094

2

2

Irs Issues Draft Form 1095 C For Aca Reporting In 21

Aca Forms 1094 C And 1095 C And Reporting Instructions For The Aca Times

2

2

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Integrity Data

2

2

2

Form 1094 C 1095 C Reporting Basics And Ale Calculator Bernieportal

2

1095 C Reporting How To Use Affordability Safe Harbors For Integrity Data

2

2

/ScreenShot2021-02-11at12.24.19PM-2c611375f2b44f57b6181bc158b48119.png)

About Form 1095 A Health Insurance Marketplace Statement Definition

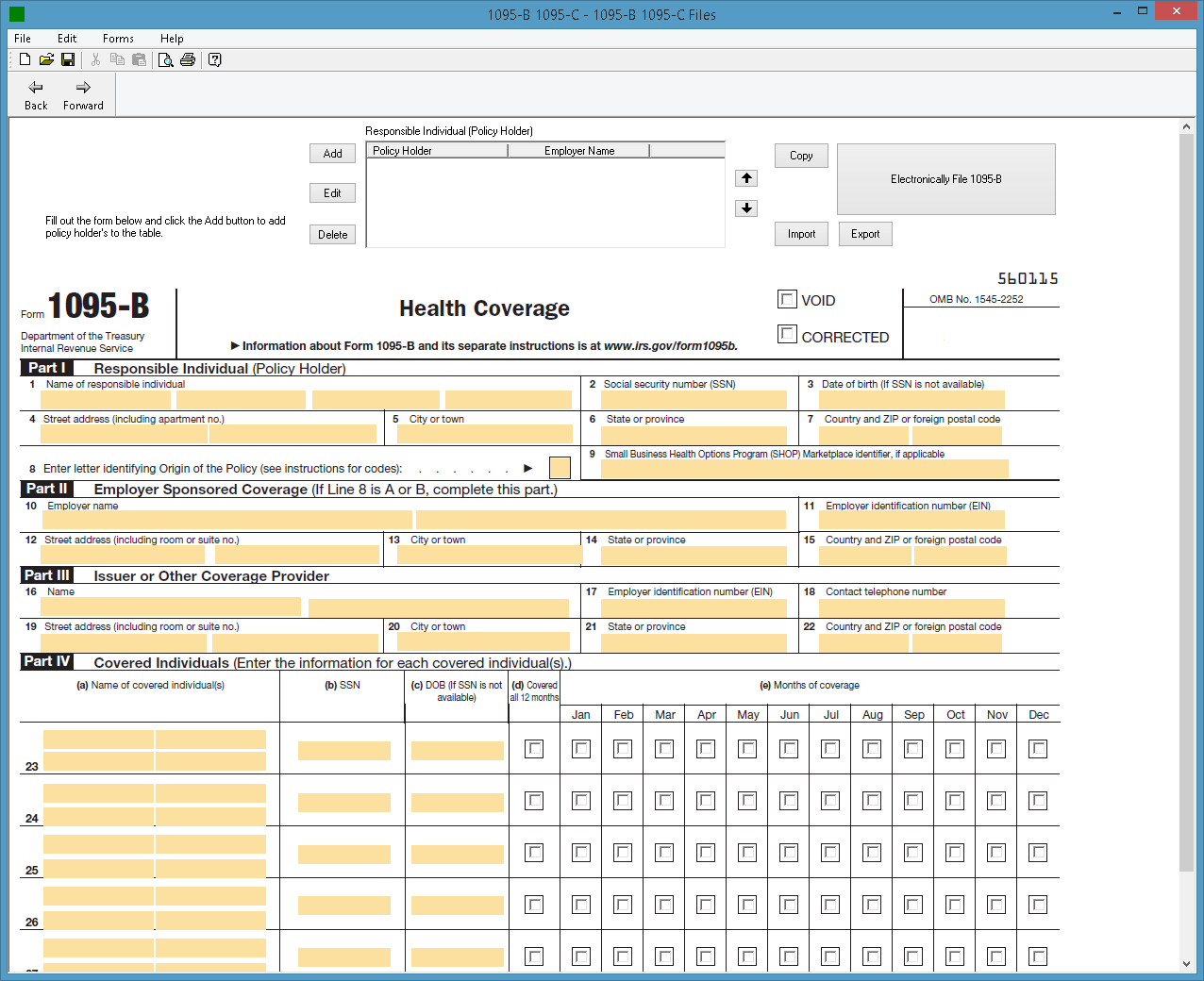

Ez1095 Software How To Print Form 1095 C And 1094 C

2

2

2

Irs Extends Deadline For Employer Aca Disclosures Buck Buck

New Form 1095 C Draft Issued By Irs For Filing In 22 Bernieportal

Control Tables And Sample Forms

2

Irs Issuing 1094 C 1095 C Penalties Essential Staffcare

2

2

19 Irs Form 1095 C Shea Insurance Llc

Aca Compliance Bulletin Draft Section 6056 Reporting Forms Released Vcg Consultants

2

2

How To Choose Form 1095 C Codes For Lines 14 16 Aps Payroll

2

Yes Employers Still Need To File Forms 1094 And 1095 Word On Benefits

Flock Standalone Aca Reporting By Flock Adp Marketplace

2

Nj Employers And Out Of State Employers With Nj Residents Prepare State Updates Website On Employer Reporting For New Jersey Health Insurance Mandate Health Employment And Labor

2

Control Tables And Sample Forms

2

Ez1095 Aca Form Software How To Import 1095 C Data From Spreadsheet

2

Form 1095 C H R Block

2

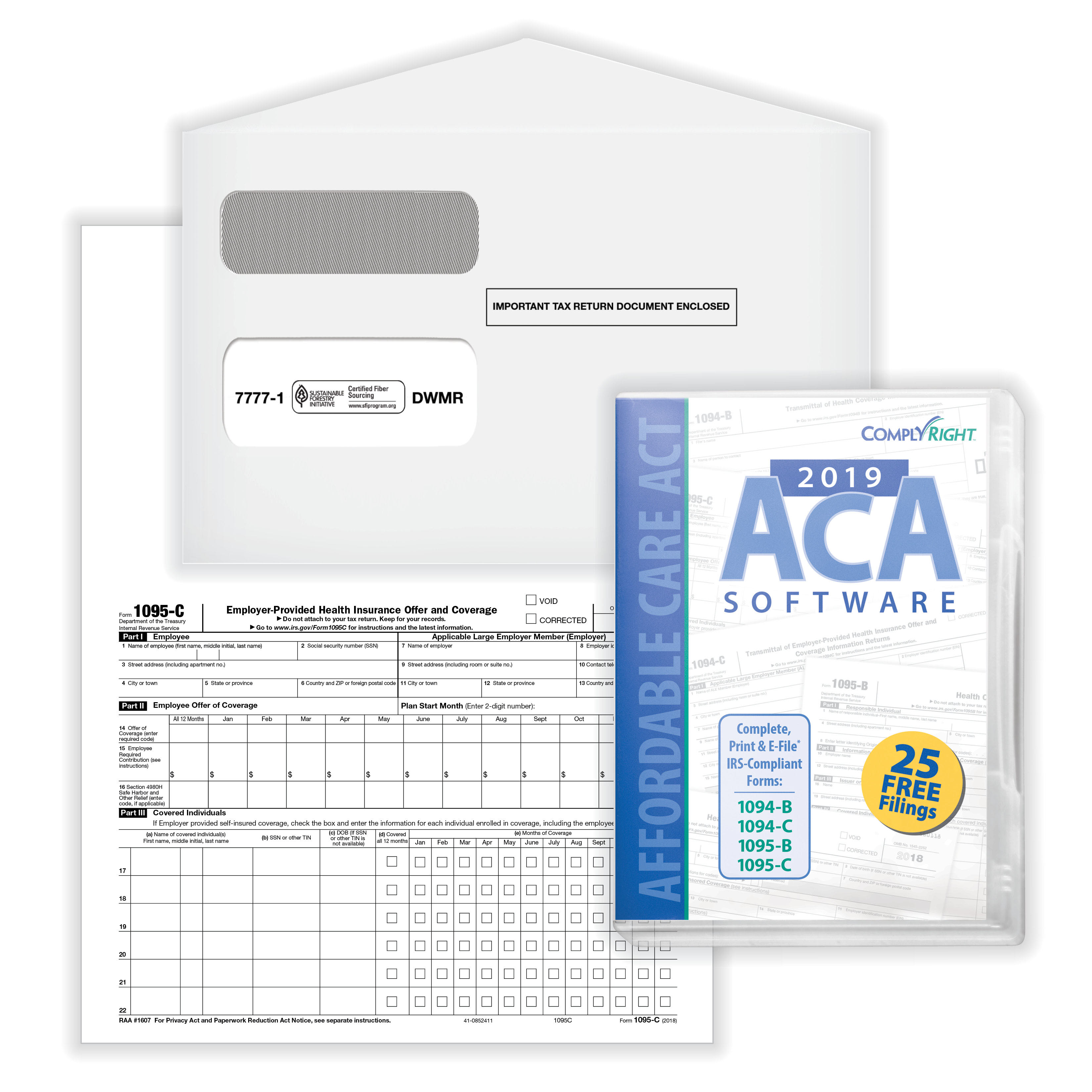

Aca Software Hrdirect

What To Do If Your Obamacare 1095 A Column B Is Zero Poorer Than You

2

Dps Ascentis Aca Brochure Pdf 791x1024 1 Jpg

2

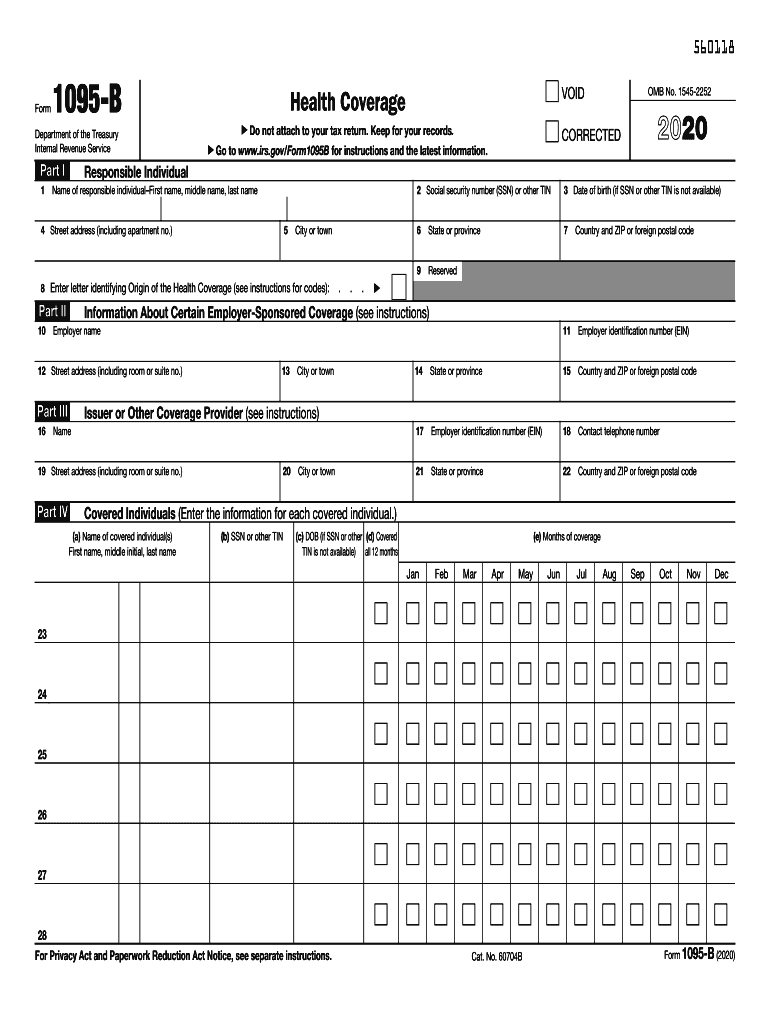

Form 1095 A 1095 B 1095 C And Instructions

2

2

Complete Guide To State Individual Mandates Tango Health Tango Health

2

Your 1095 C Obligations Explained

2

2

2

2

Form 1095 A 1095 B 1095 C And Instructions

2

The Irs Aca Audit Has Begun What To Do To Avoid Penalties The Aca Times

19 Irs Form 1095 C Shea Insurance Llc

2

Aca Forms

Mark These 19 Dates For 18 Aca Reporting Update The Aca Times

2

2

Aca Employer Reporting Requirements 1094c 1095c Efile4biz

2

Aca Deadlines Penalties Extension For 21 Checkmark Blog

Your 1095 C Obligations Explained

Tax Forms Office Depot Officemax

Get To Know Aca Forms 1094 C And 1095 C The Aca Times

Index Of Software Images

2

2

Thought Obamacare Was Gone Not Quite Accounting Today

2

Irs 1095 B 21 Fill Out Tax Template Online Us Legal Forms

0 件のコメント:

コメントを投稿